A U.S. Recession, Are We There Yet?

Former Global Chief Economist for JPMorgan Chase, PH.D. in Economics

Many a market pundit has been quoted saying, "by the time we confirm we are in a recession, we have probably been in one for a while."

This article is dedicated to my daughter Patty T. who suggested I write something on this topic!

That is not an unreasonable assumption because the National Bureau of Economic Research is a non-partisan and non-government entity in charge of identifying when a recession occurs. The last thing they want to do is get the call wrong in support of one political party over another. For this reason, the NBER typically waits to make the official announcement that we are in a recession until well after it has begun. The opposition political party (irrespective of whether they are Democrats or Republicans) often hopes the economy slips into a recession before mid-term and presidential elections to give their campaigns a boost.

Since the Fed has said it intends to fight inflation pressures with all its tools, the odds have shifted toward risking a recession. In March 2022, the core PCE inflation rate (targeted by the Fed) rose by 5.2% on a yearly basis, sharply above its 2.0% target. Bringing this rate down toward the target is tantamount to asking a professional trainer to battle a roaring lion. While it may be possible that the trainer comes out of the cage unscathed, the odds are generally not in favor of the trainer or the Federal Reserve.

Chair Powell has noted that in 1994, the Fed successfully lowered the CPI inflation rate by raising rates by 300 basis points over a 12-month period. However, the yearly rise in the CPI equaled 3.75% compared to the CPI’s latest 8.5% yearly running rate. That means the inflation problem in 1994 was only a fraction of the rise faced by the Fed today.

Are We There Yet?

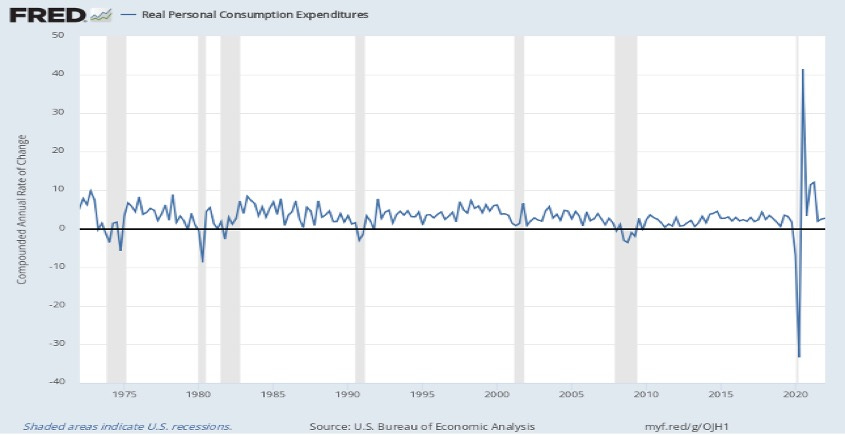

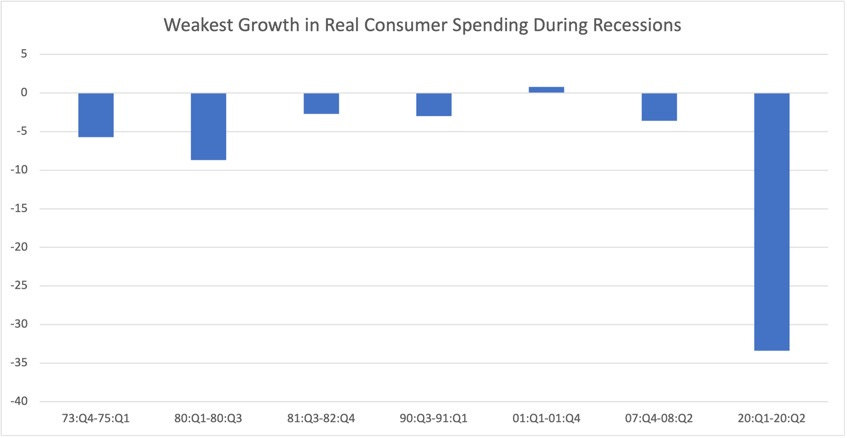

To help the reader figure out if we are in a recession today, we focused on two metrics that can provide a coincident overview of the U.S. economy. The variables we used are real Consumer Spending and real Business Equipment Spending. If consumers are worried about the state of the U.S. economy, they tend to cut back on spending, while companies tend to invest less money when they are pessimistic about the economic outlook.

Although we could have selected other variables/indicators (e.g., non-farm payrolls, PMI surveys, etc.), the GDP components selected have an impressive track record as coincident economic indicators.

Real consumer spending (which accounts for two-thirds of the overall economy) is usually much weaker than the +2.7% (SAAR) growth rate we observed in the latest Q1:2022 calendar quarter) if the U.S. economy were in the middle of a recession. Those that believe we are already in the middle of a deep recession are likely to be disappointed because during the Global Financial Crisis (GFC, 2007-2009), and the Covid-19/Lockdown Recession (Feb. 2020-April 2020), real consumer spending growth at its trough fell by -3.6%, and -33.4%, respectively.

This is not to say a U.S. recession will never occur. Dating back to 1957, (on average), a recession has made its debut every 5.7 years according to the non-partisan, National Bureau of Economic Research. That has given both political parties enough ammunition to support their campaign messages at one time or another!

Source: U.S. Bureau of Economic Analysis

Business Equipment Spending

Although the share of business investment spending is smaller than consumer spending in the economy, it represents the confidence that companies have in the overall economy. Companies boost investment when they are optimistic about the future of the economy and cut back sharply when they feel that an economic slowdown is brewing.

The data on business equipment spending in the St. Louis Fred database only goes back to 2002 but it reveals that once the U.S. economy enters a recession, the growth in real business equipment rapidly plunges. During the GFC and the Covid-19 recessions, the annualized growth rate plunged to -39.0% and -36.0%, respectively! That is a far cry from the outsized 15.3% gain observed in the latest U.S. GDP release (Q1:2022).

Against this backdrop, we believe that we are not currently in a recession! Although Q1:2022 did register a -1.4% decline in real GDP, the sources of that decline failed to offer a strong argument supporting the view that we are already in a recession. The weakness emanated from the inventory and import components that jointly subtracted -3.6% from the real GDP growth rate. The U.S. economy boosted imports because pent-up demand was partially satisfied by importing additional goods while consumers chewed through existing inventories to meet their excess demand. Those are not compelling arguments for believing we are in a recession.

Can We Slip into a Recession?

Absolutely!

The appearance of any number of Black Swans can get us there quickly. If a new Covid-19 variant emerged and caused the U.S. economy to shut down, we could enter a recession almost overnight. If the U.S. were attacked by a nuclear weapon that caused a shutdown of all U.S. economic activity, we would get a similar outcome. Finally, if the Russian-Ukraine conflict escalated further and generated increased economic dislocations, we could get there too!

Back to the Normal World

If the Fed attempted to reduce the core PCE inflation rate it targets (hovering at 5.2% today) by 320 basis points (to 2.0%) within a year or less, we would be front and center in forecasting that a U.S. recession was imminent. The key to avoiding a recession will be determined by how patient the Fed is in pushing the inflation rate back down to its target. Seeking to bring the inflation rate down towards its target within a year or less will allow the central bank to maintain its inflation-fighting credibility but risk pushing the U.S. economy into a recession. In contrast, if it proceeded more cautiously and sought to bring inflation towards its target over several years, it would lose some of its inflation-fighting credentials but lower the risk of causing a U.S. recession.

While we make no judgment on the path the Fed should take, we firmly believe that the path they choose will determine whether the U.S. economy slips into a recession in 2023 or whether the Fed has a shot at engineering a soft landing. At present, the rhetoric of the Federal Reserve implies that they are leaning toward the former strategy. However, one cannot rule out the possibility of another Fed pivot if policymakers see signs of a looming recession and become more cautious.

Since making policy decisions remains an inexact science, policymakers know that the decisions they make will only tweak the odds of generating a sequence of events rather than guaranteeing the desired outcome. The trade-off is never ideal. The first option will raise the odds of triggering a recession, while the second option could compromise the inflation-fighting credibility of the Federal Reserve. In other words, the first path will slow the surging flames of inflation pressures quicker and raise the risk of a recession, while the second path is likely to keep inflation pressures lingering around longer but reduce the odds of an impending recession.