Cracking the Code: A Smarter Way to Predict the Direction of the 30-Year U.S. Mortgage Rate

Former Global Chief Economist for JPMorgan Chase (Ph.D. in Economics) & Current Global Keynote Speaker

Getty Images: By Mohammad Farhad

Forecasting the 30-year U.S. mortgage rate has always been a challenging endeavor. Mortgage rates are shaped by a mix of global capital market forces, domestic credit demand, Federal Reserve policy, and shifting investor risk preferences. In recent decades, many housing analysts have relied heavily on models of the Treasury yield curve to better understand where mortgage rates may be heading. But one particularly rigorous approach involves pairing the Federal Reserve’s 10-year-term premium estimates with near-term macroeconomic uncertainty measures.

Why Focus on the 30-Year Mortgage Rate?

The 30-year fixed-rate mortgage holds a unique position in the U.S. financial system. It anchors housing affordability, determines borrowing capacity for households, and serves as a key transmission mechanism of Federal Reserve monetary policy into the real economy. Unlike short-term interest rates, which are highly sensitive to Federal Reserve policy announcements, the 30-year mortgage rate reflects both immediate monetary conditions and investors’ views of long-term inflation, growth, and credit risk.

Mortgage rates also include investors’ perceptions of future credit risk. Investors lending over a 30-year horizon demand compensation not only for expected future short-term rates but also for uncertainty about inflation, growth, and the potential for financial instability. Such risk, referred to as the “term premium,” is critical to understanding how mortgage rates evolve.

The Kim and Wright Term Premium Estimates

In a seminal research paper, Don Kim and Jonathan Wright of the Federal Reserve Board developed a model to estimate the 10-year-term premium, which measures how much extra yield is needed to compensate lenders for lending funds over a long-term horizon. Kim and Wright used:

Continuously compounded zero-coupon yields extracted from the Treasury yield curve

Professional forecasts of Treasury bill rates to anchor expectations of short-term policy paths

Macroeconomic variables, including the unemployment rate and inflation expectations

Survey data on inflation uncertainty, such as the dispersion of long-run forecasts from the Blue-Chip Economic Indicators survey, of which I have been a forecasting panel member for 35 years.

By combining market-based and survey-based information, Kim and Wright were able to decompose observed long-term interest rates into two components: the expected path of short-term policy rates and the term premium demanded by investors.

Of particular importance is the 10-year forward term premium estimate—that is, the model’s projection of the term premium 10 years into the future. Because the 30-year mortgage rate is a long-term rate, it should be more closely tied to investors’ perceptions of risk far into the future.

A Lagged Forecasting Framework

The innovative step in our approach is to lag the 10-year term premium estimate by 10 years to forecast the direction of the 30-year mortgage rate. Put differently, we use the model’s projection of market risk and uncertainty from a decade ago as an anchor for today’s 30-year mortgage rates.

This structure has a strong intuitive appeal. The 30-year mortgage rate reflects the market’s expectation of risks and returns over decades. A measure of the term premium that explicitly captures investor sentiment about risks 10 years into the future—when lagged—aligns with the horizon of the mortgage rate being forecast.

Between 2000 and 2021, this relationship was remarkably tight. The lagged 10-year term premium tracked the 30-year mortgage rate with little persistent deviation. Forecasts generated from the lagged premium provided a stable, historically grounded benchmark for mortgage rates.

However, after 2021, the relationship weakened. The spread between the 30-year mortgage rate and the lagged 10-year term premium widened significantly.

Source: The St. Louis Federal Reserve and the Board of Governors of the Federal Reserve System

What Happened After 2021?

The period following the COVID-19 pandemic saw several unusual developments in financial markets:

1. Surging inflation: Inflation rose to levels not seen in four decades, prompting aggressive Federal Reserve rate hikes.

2. Federal Reserve Balance Sheet: The Fed’s large-scale bond purchases during the pandemic compressed yields, then its pivot to balance sheet reduction pushed them higher.

3. Heightened uncertainty: Geopolitical tensions, fiscal policy shifts, and pandemic aftershocks all contributed to rising macroeconomic uncertainty.

These factors changed the way mortgage investors priced long-horizon risk. While the 10-year lagged term premium continued to reflect historical market expectations, it wasn’t able to fully account for these additional black-swan risks that emerged in real time. This led to a widening spread between the 30-year mortgage rate and the lagged 10-year term premium.

Adjusting the Model: The JLN Uncertainty Index

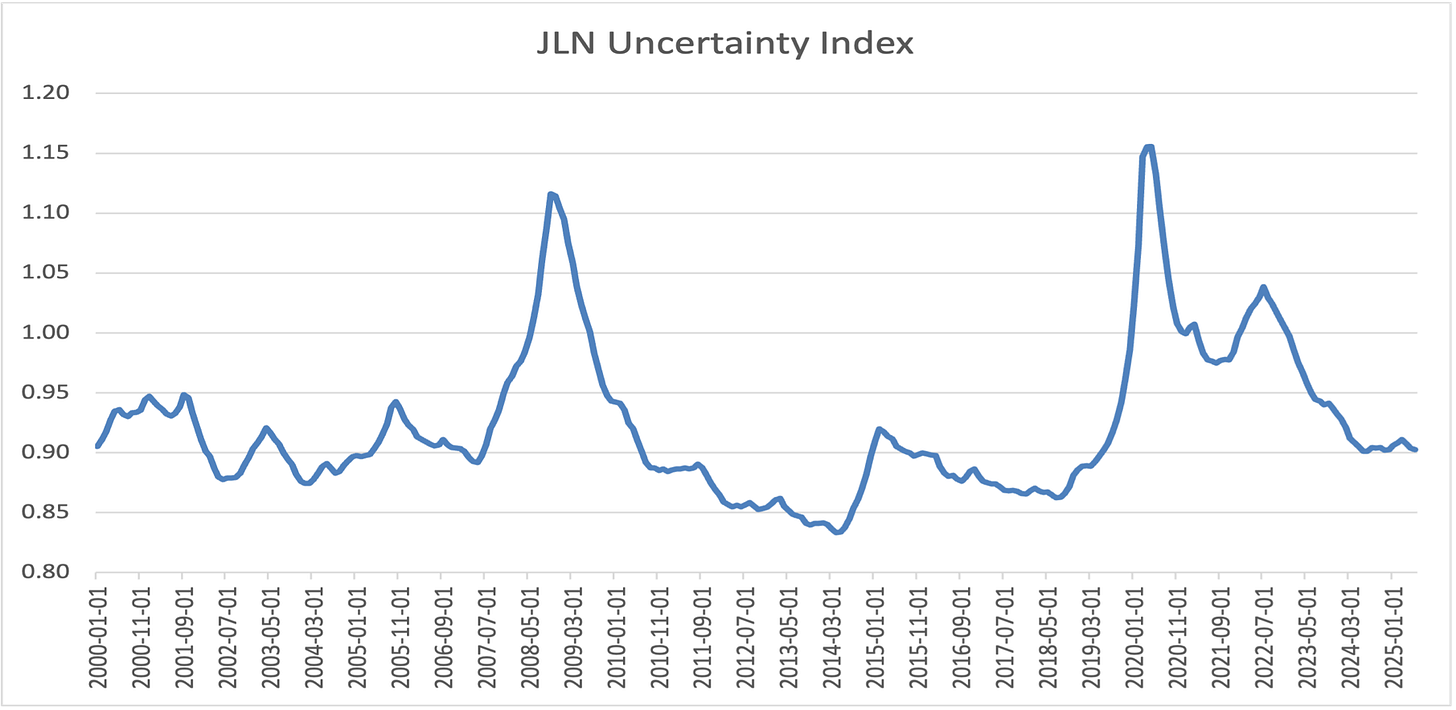

To address this breakdown, we incorporate the Jurado, Livingston, and Ng (JLN) macroeconomic Uncertainty Index, specifically the 1-year-ahead measure. This index is designed to capture one-year forward-looking uncertainty surrounding the U.S. economy by aggregating a large set of economic and financial indicators.

The JLN index differs from the lagged 10-year term premium in two critical ways:

Near-term focus: While the term premium reflects long-run expectations, the JLN measure captures evolving uncertainty within the next 12 months!

Dynamic responsiveness: The JLN index reacts more quickly to shocks, such as unexpected inflation, geopolitical risks, and financial market volatility.

Empirically, we find that when the JLN 1-year uncertainty index rises, the spread between the 30-year mortgage rate and the lagged term premium estimate tends to widen. Conversely, when the JLN measure falls, the spread narrows.

Source: The St. Louis Federal Reserve and the Board of Governors of the Federal Reserve System

This makes sense conceptually. Investors may demand additional compensation when near-term uncertainty rises, even if long-horizon expectations remain stable. That extra compensation is expressed in a higher mortgage rate relative to the lagged 10-year term premium.

A Two-Step Forecasting Model

Putting these pieces together, we arrive at a more accurate forecasting framework for the 30-year mortgage rate:

1. Baseline forecast: The lagged 10-year term premium estimate generated by (Kim and Wright’s methodology)

2. Adjustment factor: The JLN 1-year uncertainty index, which accounts for deviations driven by evolving near-term risks

The baseline provides a historically grounded long-run anchor, while the adjustment ensures responsiveness to recent shifts in economic conditions. Together, our framework strikes a balance between stability and adaptability.

What Are the Benefits of Our Forecasting Mechanism?

1. Housing affordability projections: Policymakers, lenders, and households can use the lagged term premium as a baseline estimate of mortgage rates, then adjust based on the JLN index to anticipate potential deviations.

2. Market risk monitoring: A sharp rise/drop in the JLN index should serve as a warning sign that mortgage rates may run persistently above/below our long-term benchmark.

3. Policy communication: By highlighting the interplay between long-run risk premiums and short-run uncertainty, the modeling framework underscores the importance of clear Federal Reserve communication in anchoring investor expectations.

Looking Ahead

At present, the spread between the lagged 10-year term premium and the actual 30-year mortgage rate remains wider than in the pre-2021 period. Tracking the JLN 1-year uncertainty index each month will be critical in determining the direction of the 30-year U.S. mortgage rate.

If uncertainty eases—through stabilizing inflation, clearer fiscal policy, or reduced geopolitical tensions—we might expect mortgage rates to move closer to the lagged term premium benchmark. Conversely, if uncertainty rises, mortgage rates could remain elevated relative to historical projections.

Ultimately, this two-step model provides a rigorous framework when forecasting future mortgage rates. Grounding forecasts in both long-run expectations and near-term risk perceptions reflects the complex reality of financial markets where history and uncertainty constantly interact.

At present, our JLN uncertainty index remains above its low readings observed in 2018, but we have noticed that the index is moving lower. If the index continues to move lower and we don’t see any additional adverse developments in the areas of U.S. economic policy, geopolitical risk, fiscal or monetary policy uncertainty, or a surge in inflation, we would view that as a signal that the U.S. mortgage rate will likely move lower over the next 12 months.

The JLN index tends to give us an advanced sneak preview of both adverse and favorable factors that may be entering into our U.S. economic landscape. .

Summary and Concluding Thoughts

Forecasting the direction of the U.S. 30-year mortgage rate requires balancing stability with adaptability. The lagged 10-year term premium estimate from Kim and Wright offers a powerful historical anchor that aligns with the long-horizon nature of mortgage rates. But as the post-2021 period has shown, relying on this measure to forecast U.S. 30 mortgage rates is not enough.

By incorporating the JLN 1-year uncertainty index, analysts can capture how evolving economic risks can also impact the direction of U.S. mortgage rates. This framework reveals that the interplay between long-run expectations and short-term fluctuations in economic uncertainty influences the 30-year mortgage rate.

At present, there is some hope for U.S. prospective homebuyers as the prospects are that the 30-year mortgage rate (which saw its weekly average rate hovering at 6.26% (for the week ending on September 18, 2025) could be lower one year from now if the JLN uncertainty index continues to move lower.

However, the 10-year Treasury yield was inching higher from 4.06% when the Federal Reserve lowered its policy rate by 25 basis points (September 17, 2025) to 4.13% at the time of this writing, which suggests that over the near-term, the U.S. 30-year mortgage rate could move slightly higher.