Even Shakira Might Tell the Federal Reserve: The TIPS Don’t Lie

Former Global Chief Economist for JPMorgan Chase (Ph.D. in Economics) & Current Global Keynote Speaker

Gettys Images: Kevin Winter

If Shakira were a bond trader, she would tell us that the gold standard for measuring inflation expectations is the breakeven rate derived from the Treasury Inflation-Protected Securities (TIPS) market. The breakeven rate, which influences long-term rates such as the average 30-year mortgage rate, is the difference between the yield on a nominal 10-year Treasury security and the yield on a 10-year Treasury Inflation-Protected Security (TIPS).

And yes, Shakira would say that the TIPS breakeven rates don’t lie!

Source: Federal Reserve Bank of St. Louis

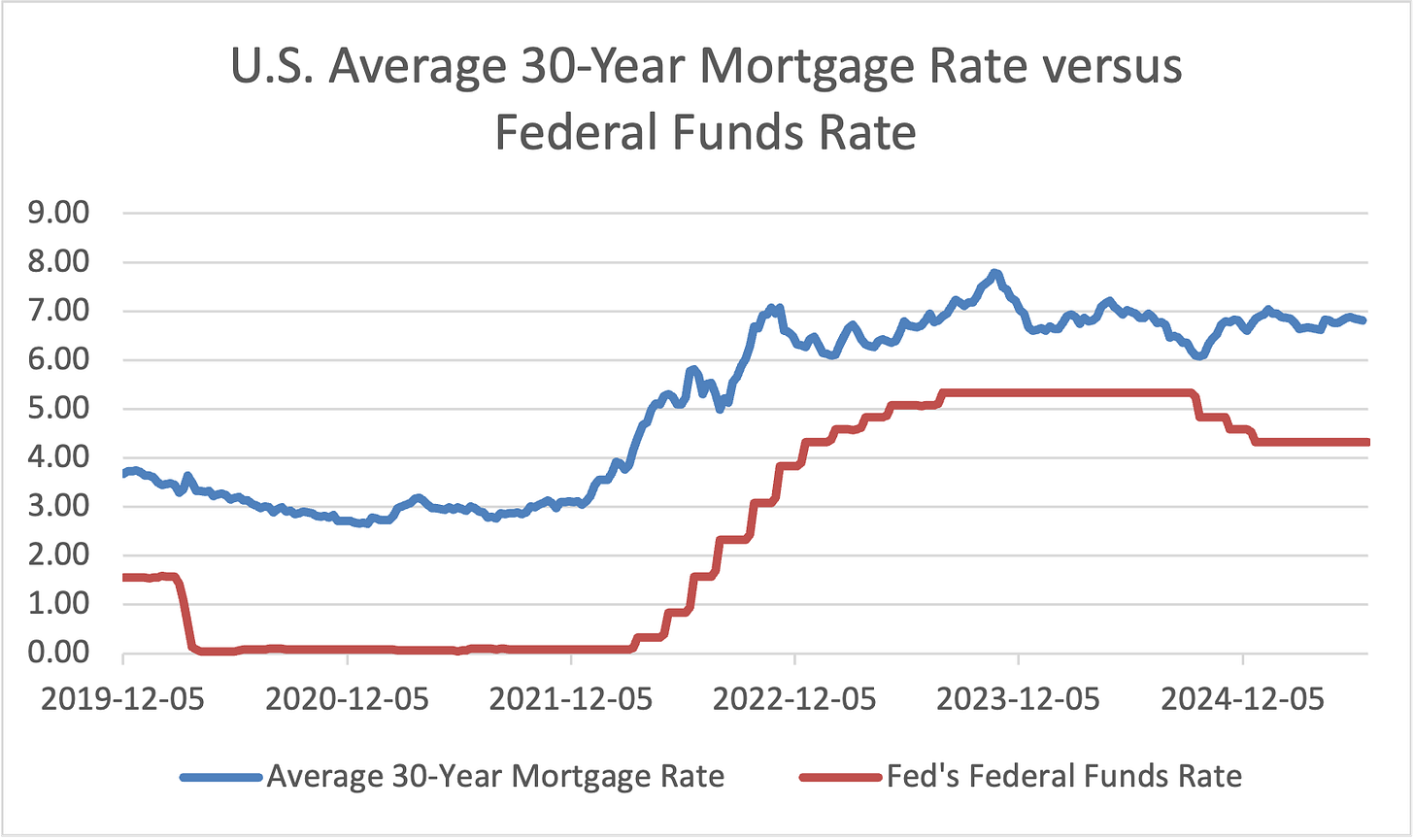

The TIPS breakeven rates signal whether bond market investors expect inflation to decline or rise. The empirical evidence suggests that fluctuations in the Treasury breakeven rates have a significantly greater impact on long-term yields, such as the 10-year Treasury yield and the average 30-year mortgage rate, than the federal funds rate, which the U.S. Federal Reserve controls.

Pressure on the Federal Reserve

President Trump’s rhetoric and social media posts have repeatedly targeted Fed Chair Powell, urging the central bank to slash interest rates “200 to 300 basis points” in 2025 to “get America moving again.” Trump’s call for significant interest rate cuts is based on the belief that monetary easing will directly reduce long-term Treasury yields, like the 10-year note, which is closely linked to 30-year mortgage rates and government borrowing expenses. On the surface, these claims have some appeal: if rates go down, borrowing becomes cheaper.

In truth, if the Trump administration wants to lower long-term interest rates and mortgage rates, it must focus on shaping bond investors' expectations, which indicate their view of future inflation through the TIPS market, trading around $12.5 billion daily. Why would bond investors be willing to lend money over the next 10 to 30 years at a lower interest rate just because the Federal Reserve lowered rates if they believed that inflation was likely to rise over that same period due to higher budget deficits or for other reasons?

Without a sustained decline in the TIPS breakeven rate or inflation expectations, long-term yields are likely to remain stubbornly high, regardless of how aggressively the Fed cuts short-term rates. And that’s the problem: bond market investors don’t seem to believe that current or future inflation will decrease if the Fed lowers interest rates.

The Problem: Credit Market Inflation Expectations Are Not Falling

The evidence from the TIPS market shows a troubling trend. In September 2024, the 10-year breakeven inflation rate stood at 2.13%. But by June 20, 2025, it had risen to 2.31%. This might seem like a slight increase, but in the world of long-term interest rates, it's significant. It suggests that investors anticipate higher inflation in the future than they did 9 months ago, despite a series of Fed rate cuts in 2024.

Source: Federal Reserve Bank of St. Louis and Board of Governors of the Federal Reserve

Why is this happening? A few likely culprits stand out:

Rising tariffs have increased input costs for U.S. companies. Some worry that these costs may eventually be passed on to consumers, potentially leading to higher inflation.

Fiscal Deficits: The U.S. budget deficit remains elevated, and with no credible plan to reduce spending or raise revenues, investors are demanding a premium to hold longer-term debt, fearing it will be inflated away.

Immigration and Labor Markets: Stricter immigration policies can reduce the labor supply in key sectors, potentially leading to higher wages and costs, and subsequently, higher inflation.

On the positive side, if these risks do not materialize, inflation expectations and breakeven inflation rates will decrease, resulting in lower long-term rates. This could explain why Fed Governors Waller and Bowman support the idea that the Fed might cut rates as early as July 2025 if the U.S. labor market shows signs of weakness, even if inflation remains above its 2.0% target. Specifically, Fed Governor Waller noted that although tariffs are likely to push up the U.S. inflation rate, the Fed can dismiss the increase because it may be a one-time effect.

The Relationship That Matters: TIPS vs. 10-Year Yield

Let’s quantify how tightly TIPS expectations anchor Treasury yields. Economists have long noted that the nominal 10-year Treasury yield is structurally made up of the real TIPS yield plus the 10-year breakeven inflation rate. This relationship was on full display in 2024, after the Federal Reserve cut its policy rates, while the TIPS breakeven rate failed to move lower.

Source: Freddie Mac and St. Louis Federal Reserve

Specifically, in January 2025, the 10-year TIPS breakeven rose approximately 37 basis points to 2.40% due to inflation concerns sparked by fears surrounding tariffs and labor market bottlenecks, which pushed long-term yields higher. A widening inflation risk premium amplified the effect, and U.S. Mortgage rates failed to decline even after the Federal Reserve began reducing its policy rates in September 2024. The 100-basis point reduction in 2024 did nothing to prevent U.S. mortgage rates from moving higher!

Source: Freddie Mac and St. Louis Federal Reserve

Summary and Concluding Thoughts

Although we would like to think that a lower federal funds rate is the magic bullet for reducing mortgage rates and long-term Treasury yields, thereby lowering debt service costs, evidence from the credit market suggests otherwise.

If credit markets anticipate higher inflation, long-term interest rates will also rise, regardless of how much the Fed reduces short-term rates. Additionally, aggressive rate cuts aimed at stimulating the economy might even increase inflation concerns, push up yields, and raise borrowing costs for households and the U.S. government, which is already trying to finance nearly $37 trillion in federal debt.

This means that jawboning the Fed won't bring down yields unless we bring down inflation expectations in the credit market. As a former Economist at the Federal Reserve, I find the evidence quite disappointing, as it reveals that the Fed’s power to influence U.S. mortgage rates and long-term Treasury yields is limited.

It’s the bond market – or bond market vigilantes, which are really in control, a phrase coined by respected conservative economist and strategist Ed Yardeni, vindicating Shakira’s dictum that the TIPS don’t lie!