President Trump Urges Retailers to ‘Eat the Tariffs’—But Can They Afford To?

Former Global Chief Economist for JPMorgan Chase (Ph.D. in Economics) & Global Keynote Speaker

Getty’s Image of a Department Store

President Trump recently renewed calls for U.S. companies, including large retailers like Walmart, to “eat the tariffs” on Chinese imports rather than passing those costs on to consumers. The statement, echoing earlier trade war rhetoric from his administration, during which the President chastised Amazon for hinting that it might have to raise prices to account for the tariffs, may sound appealing to budget-conscious Americans. However, the economic reality behind U.S. corporate profit margins and tariff math makes this request nearly impossible to fulfill, at least without pushing companies into the red.

Tariffs vs. Retail Margins: The Numbers Don’t Lie

The key issue at hand is profit margins. Most U.S. retailers operate on razor-thin margins, particularly those in the discount and grocery segments. In 2024, Walmart’s average net profit margin was 2.63%. That figure represents the share of each dollar in revenue that remains after all costs—labor, rent, inventory, logistics, and more—are paid.

Currently, a 30% tariff is imposed on most Chinese imports. If Walmart were to absorb this tariff rather than pass it on to consumers, it would obliterate its profit on any China-sourced merchandise and force the company to sell those goods at a 27.4% loss. That’s not hyperbole—it’s simple arithmetic. A company making 2.63 cents on every dollar can’t sustain a 30-cent tax per dollar without either raising prices or suffering large-scale losses.

Even companies that source fewer goods from China are not immune. While Walmart does maintain a more domestic-centric supply chain than, say, Target, it still imports a substantial amount of electronics, apparel, and seasonal merchandise from Asia. And Walmart's size means any sizable hit to profitability from tariffs can ripple through suppliers, investors, and employees.

Other Retailers Are Even More Vulnerable

Walmart isn’t alone. Consider the profit margins of other major U.S. retailers in 2024:

Kroger: 1.65%

Costco: 2.85%

Target: 2.99%

These margins are not high enough to absorb even a 10% baseline tariff, let alone a 30% one on Chinese goods. If retailers were to comply with Trump's request and forgo raising prices, they would be actively destroying shareholder value and jeopardizing their long-term viability. It’s akin to asking a household living paycheck to paycheck to cover a 30% rent increase without any additional income.

Moreover, many of these companies already operate under significant cost pressures—minimum wage increases, rising healthcare costs, and investments in automation and e-commerce infrastructure. Tariffs are just one more cost, and one too large to ignore.

Yale’s Estimate: The Bigger Picture

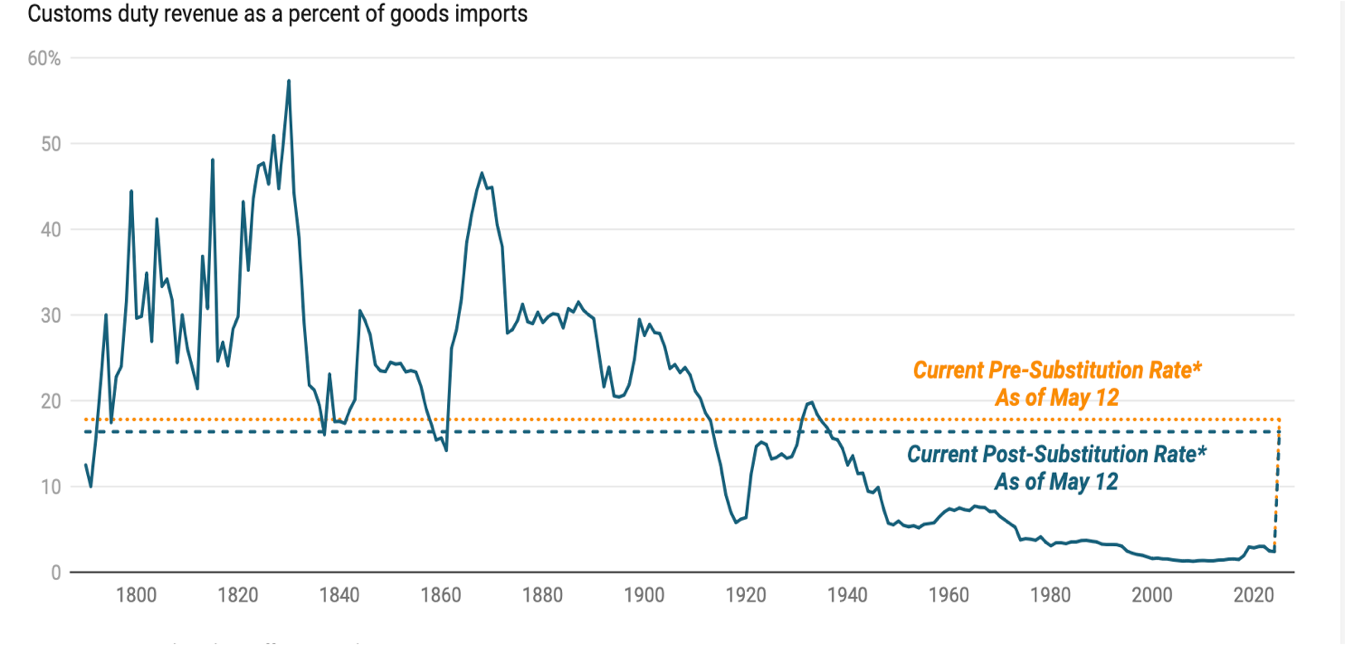

According to recent estimates by the Yale Budget Lab, the average U.S. tariff rate on all imports currently hovers around 17.8%—far above the net profit margins of nearly every major American retailer. This average encompasses tariffs on countries beyond China and spans various sectors. If these tariffs are not passed on, they would serve as a hidden tax on the retail industry that would hurt the bottom line of every firm that sells imported goods.

Source: The Yale Budget Lab

This erosion isn’t limited to retailers. Even among the S&P 500, the most profitable and operationally efficient U.S. companies, the latest Q1:2025 net profit margin stood at 12.4%. It averaged 11.7% over the last five years, which is still below the average U.S. tariff rates. That should set off alarm bells. If larger companies like Apple, Microsoft, and Visa can’t achieve a wide enough profit margin to absorb average tariffs, what hope do lower-margin retailers have?

While many believe that U.S. imports consist primarily of cheap T-shirts and shoes, the reality is that 44.5% of all U.S. imports are used as intermediate goods to produce final goods.

Source: The Federal Reserve Bank of San Francisco

Can Companies Take the Hit?

The suggestion that firms could voluntarily absorb tariffs as a patriotic gesture is great, but unrealistic. Publicly traded companies have a fiduciary duty to maximize shareholder value. Suppose executives at Walmart or Target intentionally chose to forgo profits, let alone run at a loss, to accommodate White House policy. In that case, they’d likely face lawsuits from investors and see their stock prices collapse.

Nor is it clear that such a move would produce long-term benefits. Temporarily absorbing tariffs might win consumer goodwill, but once profitability plummets, companies would have no cushion to reinvest in store improvements, wages, or innovation. Retail jobs would be at risk, capital expenditure would decline, and dividend payments could be cut. None of this would be sustainable or supported by shareholders.

Short-Term Absorption? Maybe—But It’s Risky

It is possible for a retailer to absorb tariffs over a very short period, to smooth out volatility or avoid sudden sticker shock for consumers. However, such a move would require a strong balance sheet and a clear path to reversing the losses quickly, either through renegotiated supply contracts, diversifying sourcing away from China, or passing on the costs in less obvious ways (e.g., through shrinkflation or reduced promotional spending).

Still, few companies might want to play that game. Supply chains can’t pivot overnight, and the assumption that tariffs would be short-lived is not guaranteed. The President has just warned 50 countries that the U.S. could push tariffs higher from current levels if these countries don’t reach an acceptable agreement with the United States within the 90-day self-imposed deadline set when reciprocal tariffs were paused. During the Trump 1.0 administration, many companies believed the tariffs would last months, not years. They were wrong.

Consumers May Cheer, But Reality Bites

From the average American's perspective, the idea of shielding consumers from rising prices is popular and understandable. Inflation continues to squeeze household budgets, and consumers are already growing weary of higher prices on groceries, clothes, and household goods. In the latest (May 2025) University of Michigan Consumer Sentiment Survey, consumers estimated that consumer prices will rise by 7.3% over the next 12 months.

Source: The Univ. of Michigan Consumer Sentiment Survey and CNBC

The uncomfortable truth is that tariffs are taxes on consumers, as Republican Senator Ted Cruz (Texas) has described them, and someone has to pay them. This means that if companies don’t raise prices, they lose money. If they raise prices, inflation ticks higher. If they cut costs elsewhere, it may result in layoffs, store closures, or reduced service quality. The costs don’t vanish—they shift.

Summary and Concluding Thoughts

Ultimately, the notion that companies can “eat the tariffs” as a show of patriotism or resilience is an economically challenged concept. It misrepresents the fragile reality of low-margin businesses and the competitive pressures of global commerce. Tariffs are not a one-size-fits-all weapon—they’re blunt instruments with complex consequences.

For now, major retailers are quietly lobbying against further tariff escalation and warning that higher import taxes will leave them no choice but to raise prices. That message may not be politically expedient, but it is economically honest. We can all dream of a world where patriotic corporations willingly sacrifice profits for the greater good. But in the real world of earnings reports, shareholder meetings, and razor-thin margins, dreams don’t keep the lights on. Cash flow does.

Nonetheless, we leave it to the reader to decide whether companies should bite the bullet and incur losses by absorbing tariffs, share the burden with consumers, or pass them on to the consumer.