Should the Fed Cut Rates or Wait to Act Later?

Former JPMorgan Chase Global Chief Economist (Ph.D. in Economics) and Global Keynote Speaker

Getty Images

Fed Chair Jerome Powell delivered hawkish remarks this week regarding the central bank’s monetary stance, stating that policy uncertainty complicates the formulation of the Fed’s economic strategy. While the recent easing of trade tensions should facilitate the conduct of monetary policy, the Fed must navigate the reality that trade policy remains fluid and uncertain. As always, we leave it to the reader to decide what course of action the Fed should undertake.

Against this backdrop, the Fed must determine the relationship between changes in the unemployment rate and core PCE, as well as the impact of Federal Reserve policy actions. To capture the Fed’s intentions, we used a modified Taylor rule framework that incorporates the Fed's dual mandate of achieving maximum employment and maintaining price stability. We believe that the Fed will not abandon its long-term targets for inflation and the unemployment rate, but will temporarily adjust these targets to reflect the prevailing political realities.

As a temporary baseline for its current strategy, we use the December 2024 readings of these key economic indicators, which was the last month the Fed lowered interest rates.

Key Inputs for the Fed’s Reaction Function

Unemployment Rate: 4.1% reading in December 2024 (below the Fed’s median long-run unemployment rate stated in the Fed’s Summary of Economic Projections.

Core PCE inflation: 2.7% reading in December 2024 which was above the Fed’s 2% inflation target.

The Federal Reserve’s policy decisions depend on deviations from its inflation target and the natural unemployment rate. Historical data and Fed communications suggest the following relationships:

1. Inflation Threshold

Tightening: Likely triggered if core PCE inflation rises ≥0.5% above adjusted baseline target in Dec. 2024 (to ≥3.2%). The latest reading stands at 2.7%.

Easing: Likely triggered if core PCE inflation falls ≥0.3% below adjusted baseline target (to ≤2.4%). The latest March 2025 reading stands at 2.7%.

2. Unemployment Threshold

Tightening: Likely if unemployment falls ≥0.3% below the baseline unemployment rate in Dec. 2024 (i.e., ≤3.8%). The latest reading stands at 4.2%.

Easing: Likely if unemployment rises ≥0.5% above the adjusted baseline natural rate (i.e., ≥4.6%). However, the Fed is likely to modify this figure to ≥0.25% above the adjusted baseline natural rate (i.e., ≥4.35%). The latest reading stands at 4.2%.

A simplified version of the Fed’s Taylor rule reaction function can be expressed as:

Δ Policy Rate = α(π−π∗) − β(u−u∗)

Where:

π = Current core CPI inflation (2.7%)

π∗ = Adjusted Target baseline inflation (2.8%)

u = Current unemployment rate (4.2%)

u∗ = Adjusted Natural unemployment rate (4.1%)

α,β = Traditional policy response coefficients (historically ~0.5 and ~1.0, respectively).

Against this backdrop, it should not be surprising to learn that the futures market does not expect the first monetary easing of 25 basis points, with a probability of 52.3%, until the Federal Reserve’s policy meeting on Sept. 17, 2025.

Source: CME Group

Should the Federal Reserve Cut Rates Immediately?

There is considerable debate about whether the Federal Reserve should lower interest rates immediately, given that the latest core PCE rate is rising at the same 2.7% pace as it was in September 2024, when the Fed cut rates for the first time in this cycle.

Source: Board of Governors of the Federal Reserve System

That is a valid argument, except that many of the same individuals supporting policy rate cuts today criticized the Fed for cutting rates in September 2024 because they believed the Fed should have waited until prices returned to their pre-COVID levels. Many of those same prior critics of the Fed no longer believe that the central bank needs to bring prices back to their pre-COVID levels; instead, they argue that the Fed must lower interest rates immediately.

Such evidence reveals that both sides are presenting inconsistent arguments. Logically, if a group favored or opposed rate cuts in September 2024, they should also favor or oppose rate cuts today, since the core PCE readings were identical in both periods. Instead, both camps have switched positions on this issue.

Additionally, those opposing rate cuts today point out that tariffs will tend to raise prices in the future, as evidenced by Walmart's recent announcement that prices could begin rising as early as May 2025 to reflect the imposition of tariffs. If Walmart, with all its market power over suppliers, can’t avoid higher prices, imagine the impact of tariffs on smaller retailers. This is why many industry watchers believe that Walmart’s signal to raise prices will provide a green light for other retailers to pass on the cost of higher tariffs to consumers! Some believe that such action could boost the yearly rise in headline consumer prices by an additional 1.0% over the next 12 months!

However, on the other side of this argument, others point out that with tariff rates changing every couple of weeks, one cannot rule out that any rise in prices due to tariffs could be temporary, especially if tariffs are rolled back to pre-Liberation Day levels. The temporary rollback in many of the tariffs announced in April 2025 highlights how tariffs can be with us one day and suddenly disappear into thin air!

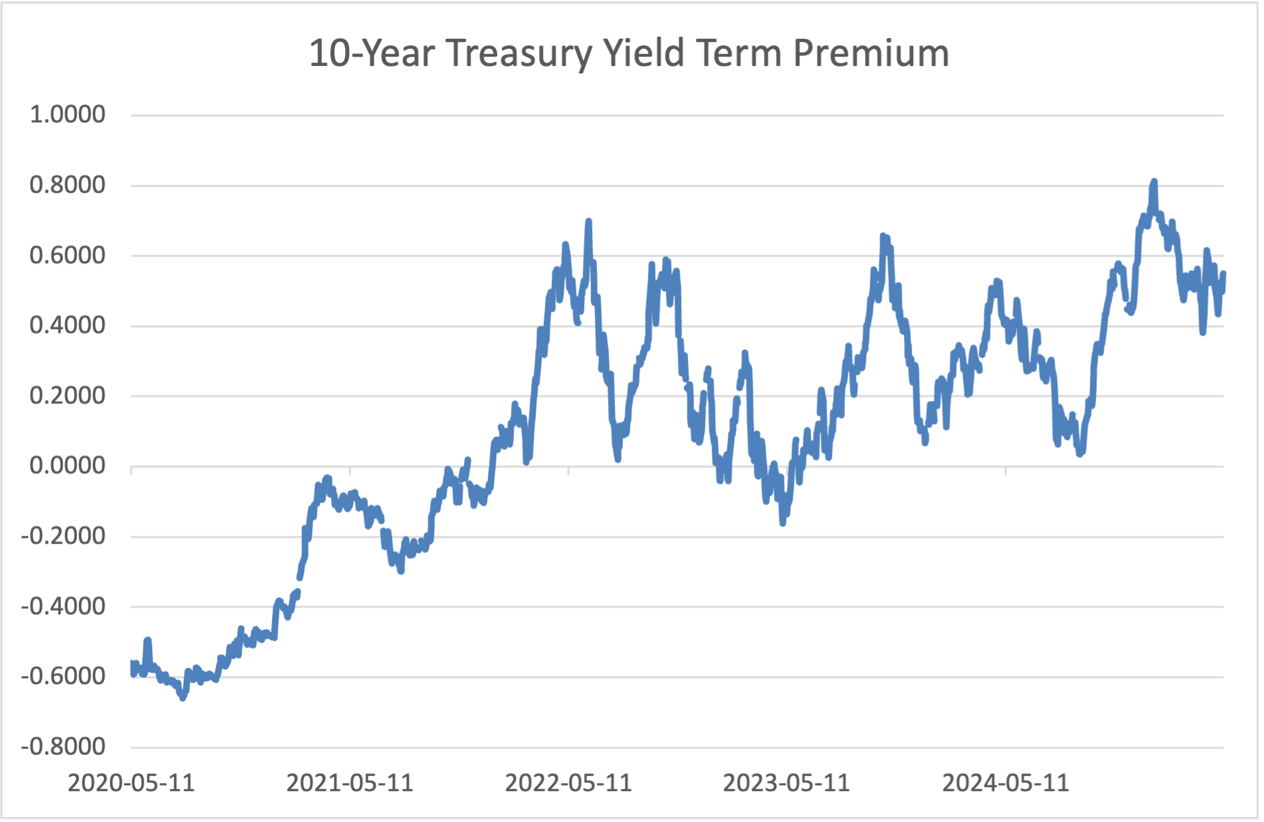

Still others argue that the Fed needs to lower the federal funds rate to support long-term investment in housing with lower mortgage rates. The problem with this argument is that the term premium, reflecting the compensation that investors demand for lending money long-term, was hovering near zero percent last year but has now rebounded to about 55 basis points. That means that lowering the federal funds rate does not guarantee that it will lead to lower mortgage rates, especially if the term premium rises further.

Source: Board of Governors of the Federal Reserve System

Summary and Concluding Thoughts

Given our nonpartisan perspective, we would like to alert our readers that opinions on whether the Fed should lower or maintain policy rates align closely along political party lines. In this context, we want to inform you that our goal is to provide our readers with the strongest arguments on both sides regarding the Federal Reserve's policy rate options.

Of course, this debate may eventually become moot, as the federal funds futures market is assigning a 52.3% probability (at the time of this writing) that the Federal Reserve will cut its policy interest rate at its September 17, 2025, FOMC meeting. While proponents of an immediate rate cut present a compelling argument that the economy will slow due to the imposition of tariffs, others argue that the tariff situation is fluid and subject to change.

However, the prevailing economic consensus indicates that tariffs generally weaken economic growth while providing a temporary rise in inflation. If this perspective holds, introducing tariffs could give policymakers valid arguments to reduce rates or keep them unchanged. The Fed Chair has skillfully managed this challenging situation by declaring that the Fed will respond to a rising unemployment rate or inflation, depending on the severity of changes in each of these economic indicators.

As always, we aim to provide our readers with the tools to make informed decisions, enabling them to choose which camp to support as the economic and political realities of the day evolve.